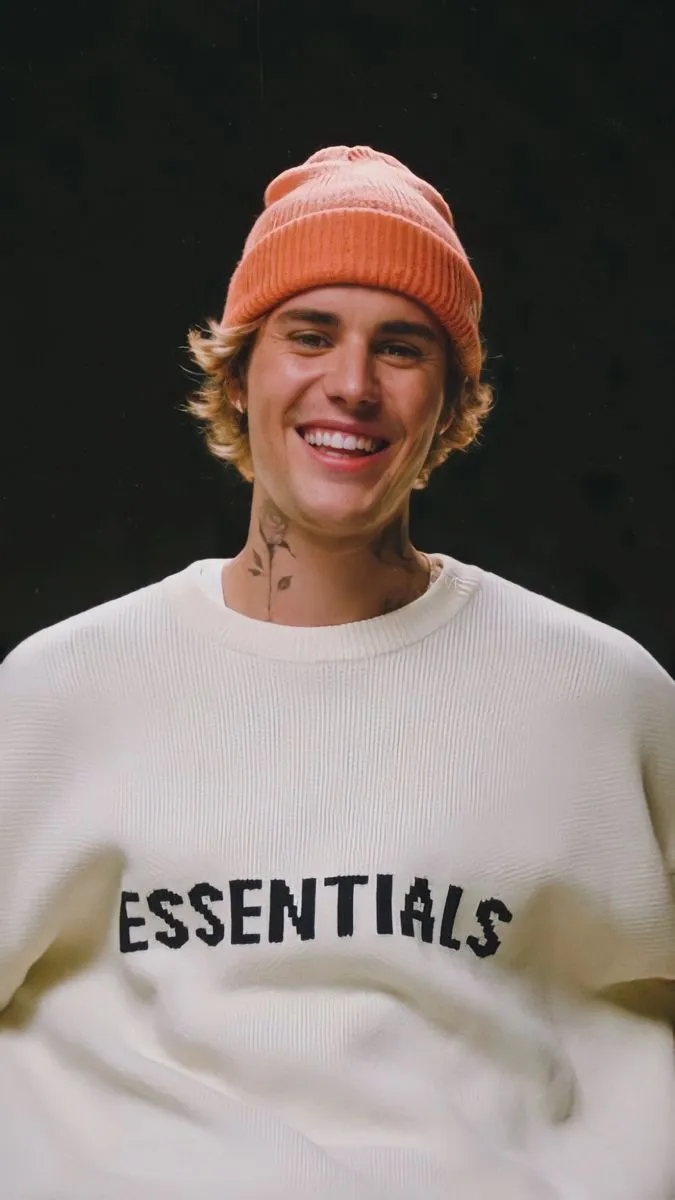

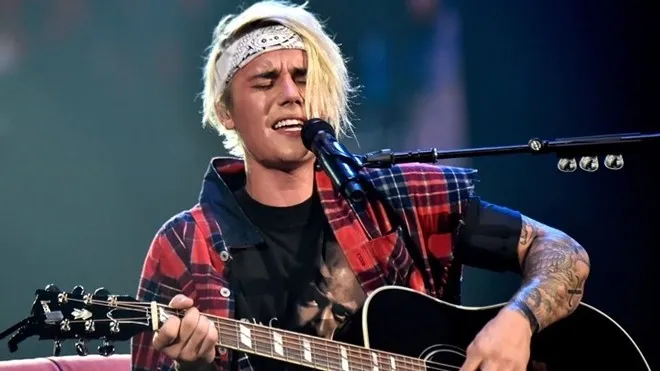

Justin Bieber’s decision to sell the rights to his entire catalog of songs marks a significant financial milestone in his career. The deal, reportedly valued at over $200 million, involves selling his music publishing rights, including both past and future compositions, to the investment firm Concord.

The move is part of a trend where artists, seeking to capitalize on the booming market for music rights, leverage their catalogs for substantial sums. Bieber’s catalog includes hits spanning his career, such as “Baby,” “Sorry,” and more recent tracks like “Peaches,” which have contributed to his global success and acclaim.

For Bieber, this deal not only secures a massive payout but also aligns with a broader strategy among musicians to monetize their intellectual property amid changing industry dynamics. The sale of music rights provides immediate liquidity while potentially ensuring future income streams through royalties and licensing.

Furthermore, Bieber joins a growing list of artists who have opted to cash in on their music catalogs, including Bob Dylan and Taylor Swift, both of whom made headlines with similar transactions in recent years. These deals underscore the increasing value placed on music rights by investors eager to capitalize on the enduring popularity of established artists.

From a financial perspective, Bieber’s decision reflects a calculated move to maximize the value of his artistic output while diversifying his portfolio beyond traditional music sales and performances. It also positions him favorably in an industry where ownership of intellectual property rights has become a strategic asset amid the rise of streaming and digital distribution platforms.

Justin Bieber’s sale of his music catalog represents not just a financial windfall but a strategic maneuver to capitalize on the evolving music industry landscape. It underscores the growing trend of artists monetizing their creative works and underscores the enduring value of hit songs in an increasingly digital world.

: Mel Gibson riceve un’offerta da 100 milioni di dollari da Netflix per lavorare con Robert De Niro, dicendo: “Tieni lontano da me quel pagliaccio sveglio”.

: Mel Gibson riceve un’offerta da 100 milioni di dollari da Netflix per lavorare con Robert De Niro, dicendo: “Tieni lontano da me quel pagliaccio sveglio”.